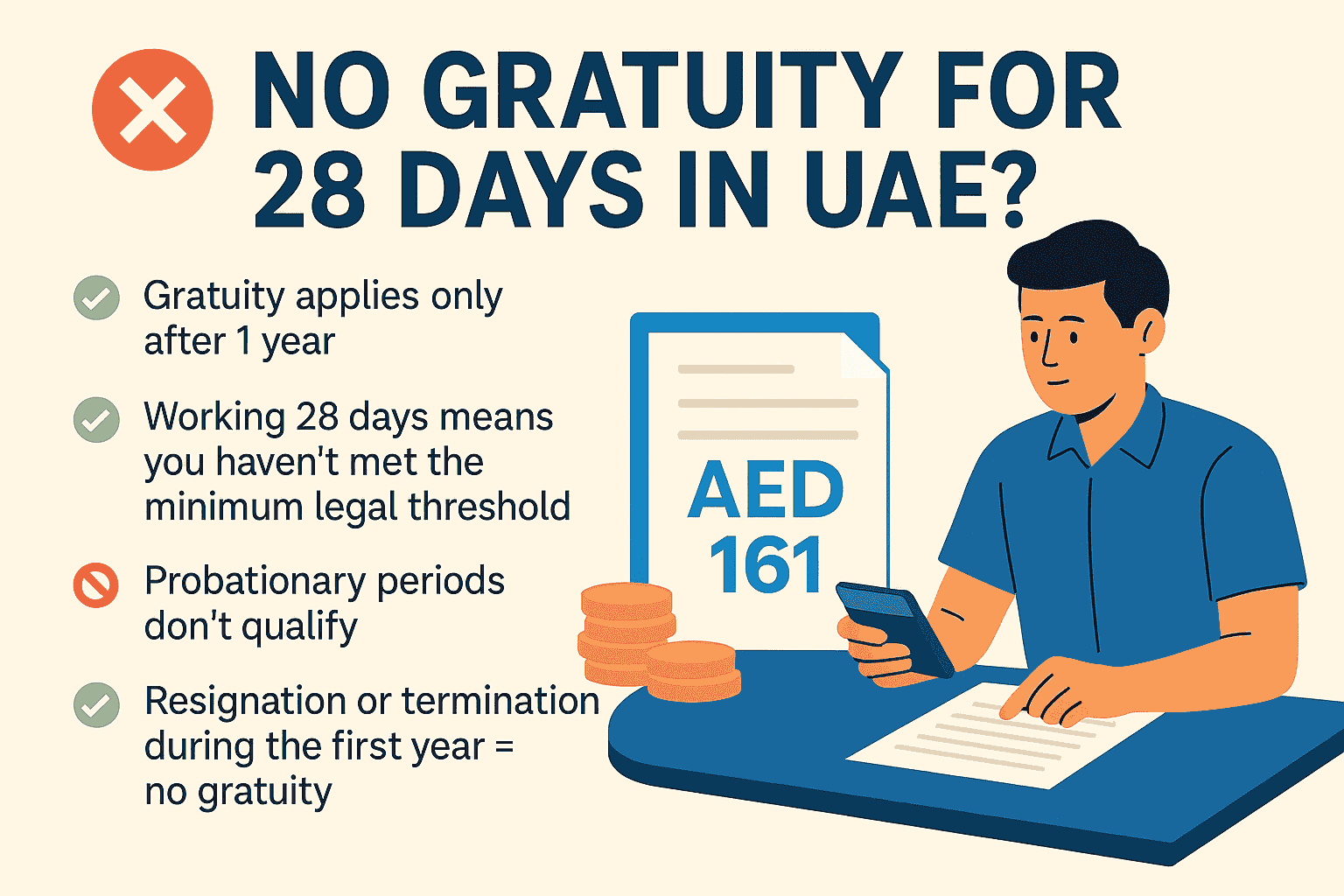

How to Calculate Gratuity for 28 Days in UAE: A Simple Guide for Short-Term Employees

So, you’ve wrapped up 28 days of work in the UAE and now you’re wondering—do I get gratuity for that? Well, you’re not alone. This question pops up all the time, especially with short-term contracts, freelancers, or people who’ve left during probation. The good news? UAE Labor Law lays it all out clearly—we just need … Read more